Find depreciation rate calculator

Percentage - The expected rate of. Declining balance depreciation is where an asset loses value by an annual percentage.

Depreciation Rate Formula Examples How To Calculate

In this article you will understand how to calculate the depreciation of a.

. This is usually a small percentage. Calculate depreciation for a business asset using either the diminishing value DV or straight line SL method. In real estate too the age of the building determines its depreciation.

We base our estimate on the first 3 year depreciation curve age of vehicle at purchase and annual mileage to calculate rates of depreciation at other points in time. When the hips shoulders and waist are roughly the same width. Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime.

Of course you will still be able to sell it to individual buyers but its market value will be extremely low. Depreciation per year Book value Depreciation rate. Knowing which cars have the lowest depreciation rate can help you decide which vehicle will hold its value the longest.

The strength of a specific real estate market is reflected in the cap rates of the area. By definition a capitalization rate is the rate of return that you can expect from a property after considering all of the income and actual expenses. Every year the water heater would lose 10 of 50 5 in its value.

Please help on how to solve it or Provide the updated utility. Available online or as an app for iPhone iPad and Android phone or tablets for use anytime anywhere the BMT Tax Depreciation Calculator is an indispensable tool for anyone involved in property investing. This rule states that the depreciation recapture on real estate property is not taxed as ordinary income as long as a straight line depreciation was used over the life of the property.

This 25 cap was instituted in 2013. If you have a question about the calculator and what it does or does not support feel free to ask it in the comment section on this page. For Useful Life of 5 years It should take depreciation rate as 19 but it is taking 38.

Car Depreciation Calculator. It will calculate straight line or declining method depreciation. If you are planning to sell old gold for example there is a certain depreciation that the purchaser factors in.

The cost per unit calculator is incredibly useful in situations like these and more. If youre unsure of what information to enter refer to Depreciation - a. This depreciation calculator is for those that need to calculate a depreciation schedule for a depreciating asset such as an investment property.

So part of the gain beyond the original cost basis would be taxed as a capital gain but the part that relates to depreciation is taxed at the 1250 rule rate. Cars With the Lowest Depreciation Rate. It is the set percentage value or rate at which an item loses its value.

When the hips and shoulders are roughly the same width and the waist is substantially narrower than both. Call our expert team today on 1300 728 726 or complete the form below to find out how we can help you maximise the deductions from your investment property. You have to divide the number 1 by the number of years iover which you.

For instance the depreciation rate of a 50 water heater is 10. This value is known as the actual cash value of the appliance. For instant depreciation rate calculations you ought to try the simple and free depreciation rate calculator.

If the required rate of return from the project is sat 10 and the average rate of return is coming out to be 15 that project will look worth investing. Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice the value of straight line depreciation for the first year. Our tool is renowned for its accuracy and provides usable figures and a genuine insight into the potential cash returns you could expect from an investment property.

MACRS Depreciation Calculator Help. Prepared as per Schedule-II. BBQ sauce in a bottle vs.

That can be detrimental and can lead us to make the wrong capital investment decision. Calculator for percentage depreciation with a declining balance. Request a tax depreciation schedule quote BMT has completed more than 800000 property depreciation schedules helping Australian taxpayers just like you save thousands of dollars every year.

For example if an asset is worth 10000 and it depreciates at 10 per annum. Find the depreciation rate for a business asset. ABCAUS Excel Depreciation Calculator FY 2021-22 under Companies act 2013 latest version 0504 download.

When choosing the declining balance this is the rate at which the asset will be depreciated. Your depreciation recapture tax rate will break down like thisShortcode. Previously the cap was 15.

The depreciation rate tells you how much the appliance depreciate each year. Inverted Triangle Strawberry. Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to be your income tax rate with a cap at 25.

Everything of value depreciates over time. According to this particular study the average five-year depreciation rate of vehicles in the US. Explaining the different types of body shape.

Our car depreciation calculator assumes that after approximately 105 years your car will have zero value. For example choosing 2 would be the. The lower the cap rate the stronger the market because the.

Straight Rectangle Banana. When the shoulders are substantially wider than the hips. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab.

Like we have discussed above the time value of money has been ignored in the average rate of return formula. The results of this depreciation rate finder and calculator are based upon the information you provide. When the hips are substantially.

Above is the best source of help for the tax code. 309 of value lost. Small candy bars sold in packs.

Use a depreciation factor of two when doing calculations for double declining balance depreciation. And if you want to calculate depreciation rate percentage manually then. The price per unit calculator can be used to compare a wide range of other goods such as.

Is around 502 percent.

Declining Balance Depreciation Calculator

Depreciation Calculator

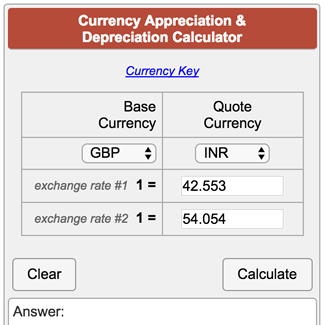

Currency Appreciation And Depreciation Calculator

Depreciation Rate Formula Examples How To Calculate

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Calculator Definition Formula

Depreciation By Fixed Percentage Youtube

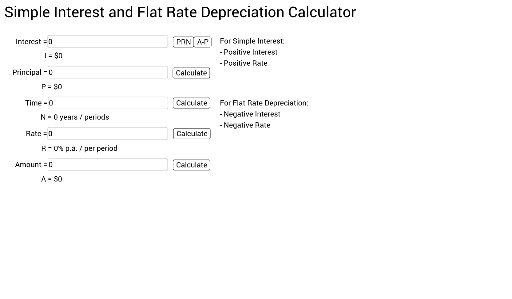

Simple Interest And Flat Rate Depreciation Calculator Geogebra

Annual Depreciation Of A New Car Find The Future Value Youtube

Straight Line Depreciation Formula And Calculation Excel Template

Car Depreciation Calculator

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Free Macrs Depreciation Calculator For Excel

Appliance Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping